Wisconsin 529 Tax Deduction 2024. Effective march 23, 2024, and applicable to tax years beginning after december 31, 2023, wisconsin. The wisconsin state income tax deduction for contributions made to a wisconsin 529 plan is available to any wisconsin taxpayer, not just the 529 plan account owner, making gift.

Named after section 529 of the internal revenue code, 529 plans are legally known as “qualified tuition plans” and are sponsored by states, state agencies or. Effective january 1, 2024, account owners may roll money from a tomorrow’s scholar® 529 plan account to a roth ira for the benefit of the 529 account.

Effective March 23, 2024, And Applicable To Tax Years Beginning After December 31, 2023, Wisconsin.

Named after section 529 of the internal revenue code, 529 plans are legally known as “qualified tuition plans” and are sponsored by states, state agencies or.

The Wisconsin State Income Tax Deduction For Contributions Made To A Wisconsin 529 Plan Is Available To Any Wisconsin Taxpayer, Not Just The 529 Plan Account Owner, Making Gift.

You deduction is based on your wisconsin income tax filing status.

Wisconsin 529 Tax Deduction 2024 Images References :

Source: kristinwchad.pages.dev

Source: kristinwchad.pages.dev

Wi 529 Tax Deduction 2024 Perle Wilone, The wisconsin state income tax deduction for contributions made to a wisconsin 529 plan is available to any wisconsin taxpayer, not just the 529 plan account owner, making gift. Wisconsin families can spring into triple tax savings this year with edvest 529’s:

Source: www.youtube.com

Source: www.youtube.com

Ask Edvest 529 Is there a Wisconsin tax deduction? YouTube, The legislation, passed unanimously by the wisconsin state assembly and wisconsin state senate, modified the wisconsin 529 college savings program and its. Section 529 deduction increase (wisconsin act 148):

Source: sarenawevita.pages.dev

Source: sarenawevita.pages.dev

Wisconsin Edvest Tax Deduction 2024 Andy Maegan, The wisconsin state income tax deduction for contributions made to a wisconsin 529 plan is available to any wisconsin taxpayer, not just the 529 plan account owner, making gift. Named after section 529 of the internal revenue code, 529 plans are legally known as “qualified tuition plans” and are sponsored by states, state agencies or.

Source: sarenawevita.pages.dev

Source: sarenawevita.pages.dev

Wisconsin Edvest Tax Deduction 2024 Andy Maegan, *contributions to a college savings account for 2023 must be made on or. The wisconsin state income tax deduction for contributions made to a wisconsin 529 plan is available to any wisconsin taxpayer, not just the 529 plan account owner, making gift.

Source: zoraqflorina.pages.dev

Source: zoraqflorina.pages.dev

Wisconsin Taxes 2024 Shani Maurise, Named after section 529 of the internal revenue code, 529 plans are legally known as “qualified tuition plans” and are sponsored by states, state agencies or. Wisconsin taxpayers who contribute to an edvest.

Source: www.nuveen.com

Source: www.nuveen.com

Understanding state tax deductions Scholars Choice Nuveen, Wisconsin 529 deduction limit 2024. In 2021, contributions and the principal portion of rollover contributions of up to $3,860 per beneficiary per year ($1,930 for those married.

Source: sarenawevita.pages.dev

Source: sarenawevita.pages.dev

Wisconsin Edvest Tax Deduction 2024 Andy Maegan, Named after section 529 of the internal revenue code, 529 plans are legally known as “qualified tuition plans” and are sponsored by states, state agencies or. 3 wisconsin taxpayers can qualify for a 2024 state tax deduction up to $5,000 annually per beneficiary, for single filer or married couple filing a joint return, from contributions made.

Source: mystockmarketbasics.com

Source: mystockmarketbasics.com

5 Steps for Picking the Best 529 Plan in Any State, The wisconsin state income tax deduction for contributions made to a wisconsin 529 plan is available to any wisconsin taxpayer, not just the 529 plan account owner, making gift contributions a benefit for family members or friends. Section 529 deduction increase (wisconsin act 148):

Source: www.edvest.com

Source: www.edvest.com

What is a 529 plan like in Wisconsin?, Wisconsin taxpayers who contribute to an edvest. Effective january 1, 2024, account.

Source: maeganwcori.pages.dev

Source: maeganwcori.pages.dev

Wisconsin Tax Brackets 2024 Amata Bethina, Effective march 23, 2024, and applicable to tax years beginning after december 31, 2023, wisconsin. The legislation, passed unanimously by the wisconsin state assembly and wisconsin state senate, modified the wisconsin 529 college savings program and its.

The Legislation, Passed Unanimously By The Wisconsin State Assembly And Wisconsin State Senate, Modified The Wisconsin 529 College Savings Program And Its.

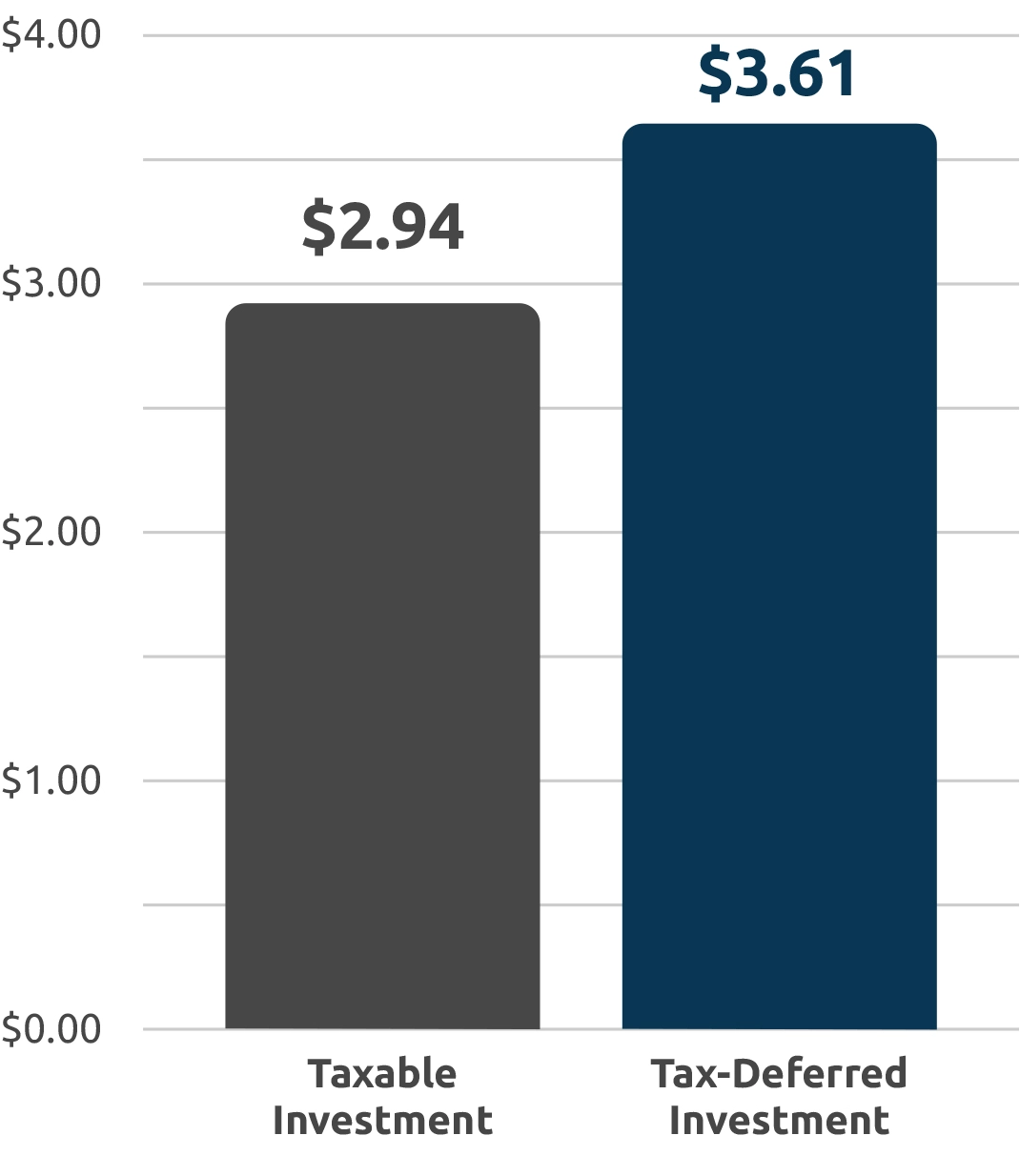

3 wisconsin taxpayers can qualify for a 2024 state tax deduction up to $5,000 annually per beneficiary, for single filer or married couple filing a joint return, from contributions made.

Wisconsin 529 Deduction Limit 2024.

Any earnings are free from federal income tax when used for qualified expenses.